And are advisers over-reliant on yield?

Scopic Research has unveiled four multi-asset income funds labelled as ‘retirement income champions’ and has called for a focus on dividend income instead of yield when it comes to measuring performance.

The ‘Retirement income champions and the safe withdrawal rate’ paper identifies a specific cohort of multi asset income funds that Scopic Research managing director Paul Ilott believes have been “unfairly overlooked”. Premier Miton, BNY Mellon, Baillie Gifford, and WS Canlife offerings have been picked as the four ‘champions’.

The retirement income champions

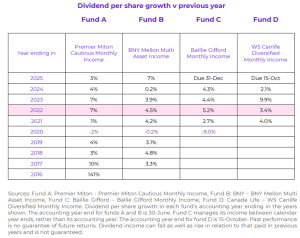

The table below shows that all funds still managed to grow their dividend incomes per share in absolute terms during their accounting years that ended in 2022. This was a period when inflation (UK CPI) spiked to its highest level in many years.

Speaking to Professional Adviser, Ilott explained that for retirees keeping their pension pot invested rather than buying an annuity the ideal goal is a replacement salary — or as close as possible.

“The capital withdrawal route is tried and tested, but sequencing risk makes it challenging to determine a truly safe withdrawal rate,” he explained. “You don’t know how long negative returns will persist or when they’ll arrive — and that uncertainty makes planning difficult.”

When assessing multi-asset funds, one of Scopic Research’s key questions was: what kind of income stream will retirees actually receive?

“Many multi-asset income funds produce highly variable income, making it difficult for advisers to plan reliable retirement strategies,” Ilott highlighted. “We found a few funds built from the ground up to deliver dependable, monthly income — and to grow that income year after year.”

The managing director highlighted that the funds in the table above stood out because they were “designed, not adapted, for income stability”.

“They were direct-security multi-asset income funds, giving managers transparency over bond coupons and dividend patterns,” Ilott added. “Managers could forecast income, anticipate shortfalls, and take action to fill the gaps — even reinvesting growth returns to sustain income.”

He said that many advisers assume all multi-asset income funds behave the same — but that is not the case.

“The industry is geared toward measuring total returns and volatility, not income stability,” Ilott shared. “Reliable income data is hard to find — and that lack of visibility is why many advisers haven’t discovered this new generation of income-focused funds.”

A focus on dividend income instead of yield

He also stated that yield is “the wrong thing to focus on” when it comes to multi-asset income funds’ performance.

“It doesn’t tell you what income your client is actually receiving,” Ilott said. “Everyone has yield data and assumes it reflects income, but it doesn’t.”

Instead, he said that what really matters is the dividend income the client has received — and that information is “surprisingly hard to find”.

“To get accurate income data, you often have to go back directly to the fund groups themselves,” Ilott shared.

For Scopic Research’s paper, it went straight to the fund groups to “uncover the real income patterns — because the public data just isn’t reliable”.

“The industry is obsessed with volatility as the measure of risk — but that’s only part of the story,” Ilott continued. “Volatility tells you how much a fund’s capital value moves, not how steady the income is.”

It is the income that matters for retirees

He explained that for retirees, it is the income that matters — and in the retirement income champion funds, that income is “remarkably stable and predictable”.

Ilott said: “If your income stream is consistent but your capital value fluctuates, the traditional risk rating misses what really matters.

“We need a new definition of risk — one that considers income predictability alongside capital volatility.

“True risk for retirees isn’t short-term price movement; it’s uncertainty in the income they depend on.”

Ilott said this cohort of multi-asset income funds has gone largely unnoticed because advisers have “understandably assumed all such funds are the same”.

“Advisers have seen variable returns and variable income and concluded they couldn’t rely on these funds for retirement clients,” he said. “In reality, we’ve identified a group of funds with a proven record of delivering stable income — and growing it year after year.”

In Scopic’s view, these funds help mitigate sequencing risk by delivering a “predictable” income stream, regardless of market volatility.

Ilott added: “Unlike capital withdrawal strategies, you’re not selling units or shares — you’re receiving net dividends on the ones you already own.

“The fund manager can tell you at the start of the year exactly what income you’ll receive — providing clarity for planning and reviews.

“If advisers know how many shares a client owns, they can forecast precisely how much income that client will receive in retirement.”

A strategy that ‘transforms financial planning’

He stated that this strategy “transforms financial planning” by “replacing uncertainty with predictability”.

Ilott continued: “It shifts the client–adviser conversation from ‘What’s happening in the markets?’ to ‘What income will I receive this year?'”

The biggest test for these funds came during Covid-19, the managing director said, when companies cut or suspended dividends.

“Even then, this cohort still managed to maintain or slightly grow their monthly income from the previous year,” Ilott said.

Across the group, during the pandemic, income fell only marginally — between –0.2% and –9% — under “the most extreme conditions”.

Ilott said considering most employees were on 80% pay through furlough, that is an “impressive outcome”.

“You can’t call it a full replacement salary — but it’s as close as you can get without taking on excess risk,” he concluded. “It’s dependable, transparent, and sustainable — and that’s exactly what retirees need.”