Breakthroughs in disruptive technologies such as artificial intelligence (AI) have recently helped to drive equity valuations to multi-decade highs. While there are concerns about the valuations of some US technology stocks in particular, Vanguard believes the progression of AI has unlocked tremendous potential for the asset management industry.

As well as the opportunity for it to be the catalyst for a surge in economic growth, the rise of AI could have significant implications for active fund managers across the value and growth spectrum.

At Vanguard, we take a sub-advised approach to the management of our active equity funds, allowing us to partner with leading active managers from around the world who we believe are best positioned to deliver long-term performance.

We often blend managers who have distinct, yet complementary approaches to managing money. The Vanguard Global Equity Fund, for example, is managed by two different fund managers: Wellington, a value-focused manager, and Baillie Gifford, a growth-oriented manager.

Both are looking to exploit AI opportunities, but in different ways. Wellington looks for companies that, while currently undervalued, are adopting AI in ways that could significantly enhance their long-term profitability and operational efficiency. Meanwhile, Baillie Gifford targets high-growth companies at the forefront of AI technology.

We look at how Baillie Gifford and Wellington consider AI as part of their respective investment strategies and how they view its potential to generate positive returns over the long term.

Wellington: Looking beyond the hype

Has the upside potential of AI been overly hyped? Or can these technologies boost long-term growth and profitability? Are heavily AI-exposed companies currently in a bubble?

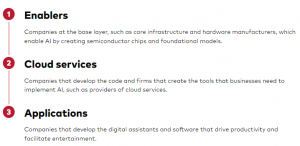

Wellington’s information technology research team believes that staying disciplined and focused on three core areas of the market is crucial when it comes to generating long-term returns within the AI space:

The investment team combines insights on these core areas of the AI market with their approach to finding mispriced opportunities to identify attractively valued stocks than can benefit from these trends over time. The team believes that this approach to finding the most promising opportunities at good entry valuations can help navigate short-term risks amid the enthusiasm of the broader market.

For example, the portfolio holds exposure to Micron Technology, a semiconductor manufacturing company, which produces memory chips related to AI infrastructure. The investment team believes that it could benefit from a likely acceleration of the memory upcycle (the repurposing of memory chips) while the company’s improving profitability and cash flow profile has the potential to drive earnings upside.

The company focuses on average sale price rather than bit growth (the smallest unit of data that a computer can process and store), as well as capital discipline. This gives the team at Wellington further confidence in the potential for long-term share price growth.

Baillie Gifford: Taking the long view

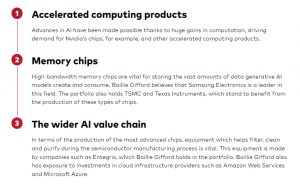

Baillie Gifford has considered the impact of technological innovation on the evolution of the stock market in recent decades. This has given it perspective on how the rapid improvements in data availability, computer processing power and machine learning techniques could fuel progress in AI.

While the team at Baillie Gifford admits that none of us can know the full implications of AI, it does believe it’s possible to analyse companies to understand the potential impact on their investment prospects. It looks for companies that could dominate in a number of AI-related areas – some are existing holdings, but AI is also challenging the team to look for new investment ideas.

For Baillie Gifford, the transformative potential of AI can be found in three key areas:

While it’s still difficult to determine the opportunities and limits of AI, fund managers are already thinking about how quickly it could affect the fortunes of companies, industries and economies over the next five to ten years and beyond.

By combining the expertise of fund managers with distinct investment strategies, investors can access a balanced approach to AI opportunities. We believe a balanced approach has the potential to deliver more consistent risk-adjusted returns over the long term.