When passive is active – the rise of ‘passive plus’ managed portfolios

For financial advisers, the choice between active and passive investment strategies is no longer binary. Managed portfolio services are increasingly targeting index-tracking funds in an active and dynamic manner, as RBC Brewin Dolphin’s David Hood, Head of Central Investment Solutions and Graeme Bowden, Regional Sales Manager, explain.

The investment landscape has undergone massive change in recent decades. The proliferation of technology, including apps and platforms, has put some investment decisions into the hands of retail investors. At the same time, the funds universe has expanded to include sectors and asset classes not previously widely available to the public.

While such choice can be viewed in a positive light, it has made life harder for financial advisers. Clients, given the option of DIY investing, have questioned advisers’ fees, while the plethora of funds available have made it challenging for advisers to actively search the whole market for the most appropriate investment solutions.

It’s unsurprising, then, that many advisers have turned to managed portfolio services (MPS) to do much of the heavy lifting. Indeed, over the five years to September 2023, MPS have grown at an annual rate of 10.9%, with their share of adviser platform assets rising from 45% to 50% .

For advisers, the benefits of MPS are clear – not least that it enables them to outsource the day-to-day management of their clients’ investment portfolios while preserving their client/adviser relationships.

Another key trend in recent years has been the rise of passive investing, largely through index-tracking funds and products. In 2023, for example, investments into US passive funds surpassed investment in active funds . One of the key drivers here is cost, with investors scrutinising fees charged by fund managers against the performance of passive versus active funds.

“Not only is there room in any given client portfolio for a combination of active and passive investments, but no two indices are the same”

Graeme Bowden, Regional Sales Manager

A perfect blend?

While the debate about active versus passive has dominated many recent investment conversations, there is a risk that it is reduced to an either/or discussion. The reality, however, is not quite so binary.

Not only is there room in any given client portfolio for a combination of active and passive investments, but no two indices are the same. It’s arguable that the level of research required in selecting passive funds has become as high as for active funds.

So, it’s a natural progression that MPS with a focus on passive investing found their way into the marketplace – creating a place where passive investments are actively researched, selected and monitored.

This is an area that RBC Brewin Dolphin has been very active in. We launched our MPS offering in 2008, making it one of the longest-running MPS products in the market. We subsequently launched our ‘Passive Plus’ MPS in 2016 having identified a gap in the market. Together with our Voyager fund range, which follows the investment approach of MPS but in a unitised structure, we centrally manage £8bn AUM.

David Hood, Head of Central Investment Solutions

Today, there are seven distinct Passive Plus portfolios selected by our in-house, expert research team, each catering to a specific attitude to risk – Cautious, Cautious Higher Equity, Income, Income Higher Equity, Balanced, Growth and Global Equity. Financial advisers match their clients to one or more of these portfolios and monitor their ongoing suitability.

Critically, these portfolios have lower fees than those holding active funds, owing to the nature of the underlying assets. What’s more, the portfolios are tactically adjusted (rebalanced) every month. This is to reflect our asset allocation committee’s view on the most appropriate mix of assets for a given investment objective and any key changes taking place in the market. Our in-depth research covers thousands of investment products.

While passive funds may be attractive from a cost and ease perspective, one of the key downsides is the potential impact on clients when any given index experiences a correction. As a result, some of our Passive Plus portfolios invest in a diversified, global basket of alternative assets through the inclusion of the MI Select Managers (MISM) Alternatives Fund, which can offer exposure to commodities, real estate, private equity and tactical credit.

This can help hedge against sudden index downturns and support portfolio diversification, which we believe should typically include alternative assets.

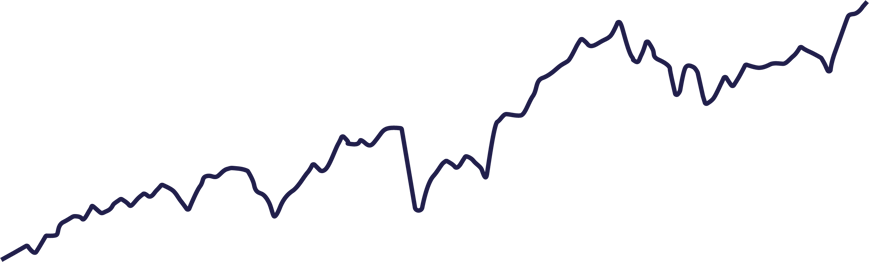

Performance since inception

IA Mixed Investment 40-85% Shares (45.22)

Balanced Portfolio Performance ON Passive Plus (48.86)

UK CPI

Source: RBC Brewin Dolphin.

As those in the financial sector are all too aware, rules and regulations on the provision of advice – such as the Retail Distribution Review and, more recently, Consumer Duty – have added an extra layer of complexity by rightfully demanding more transparency and accountability, and that value is delivered to investors.

Not only are the constituent funds of the Passive Plus portfolios available on the RBC Brewin Dolphin website, so are the Defaqto qualitative review reports, thus giving added transparency and third-party analysis.

In a constantly evolving industry, the shift into MPS not only brings cost efficiency for advisers and their clients, it also outsources increasingly complicated asset management and portfolio responsibilities. This allows advisers to spend more time on core financial planning and building and maintaining important client relationships, all the while retaining discretionary control over their clients’ accounts.